Warum Dock

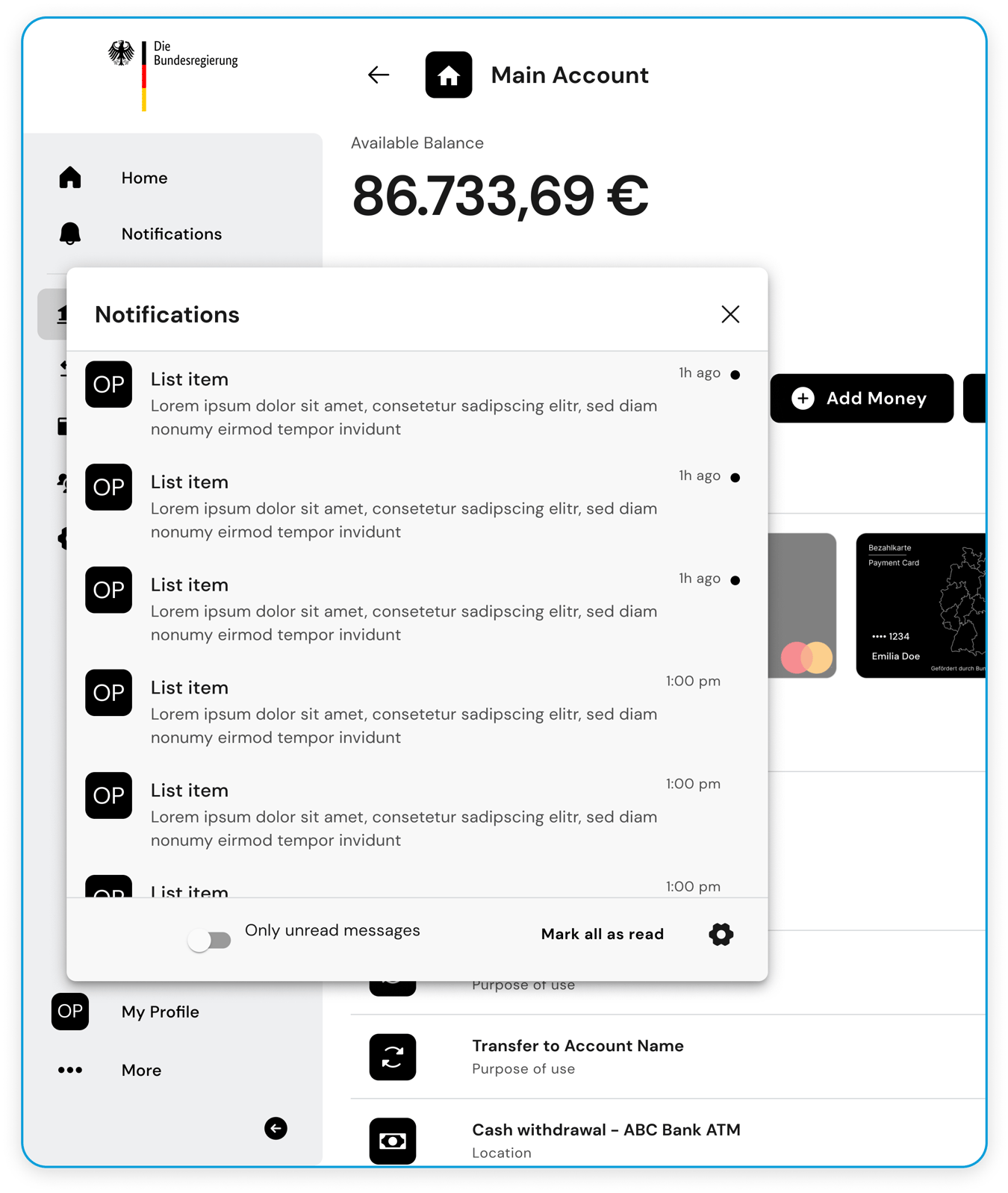

✔️ Guthabenbasierte Karte ohne Kontofunktion (sofern erwünscht perspektivisch erweiterbar um klassische Kontofunktionen wie Lastschrift und Überweisung)

✔️ Abbildung von Bedarfsgemeinschaften flexibel möglich – Finanzielle Inklusion von Frauen und Jugendlichen dadurch aktiv förderbar

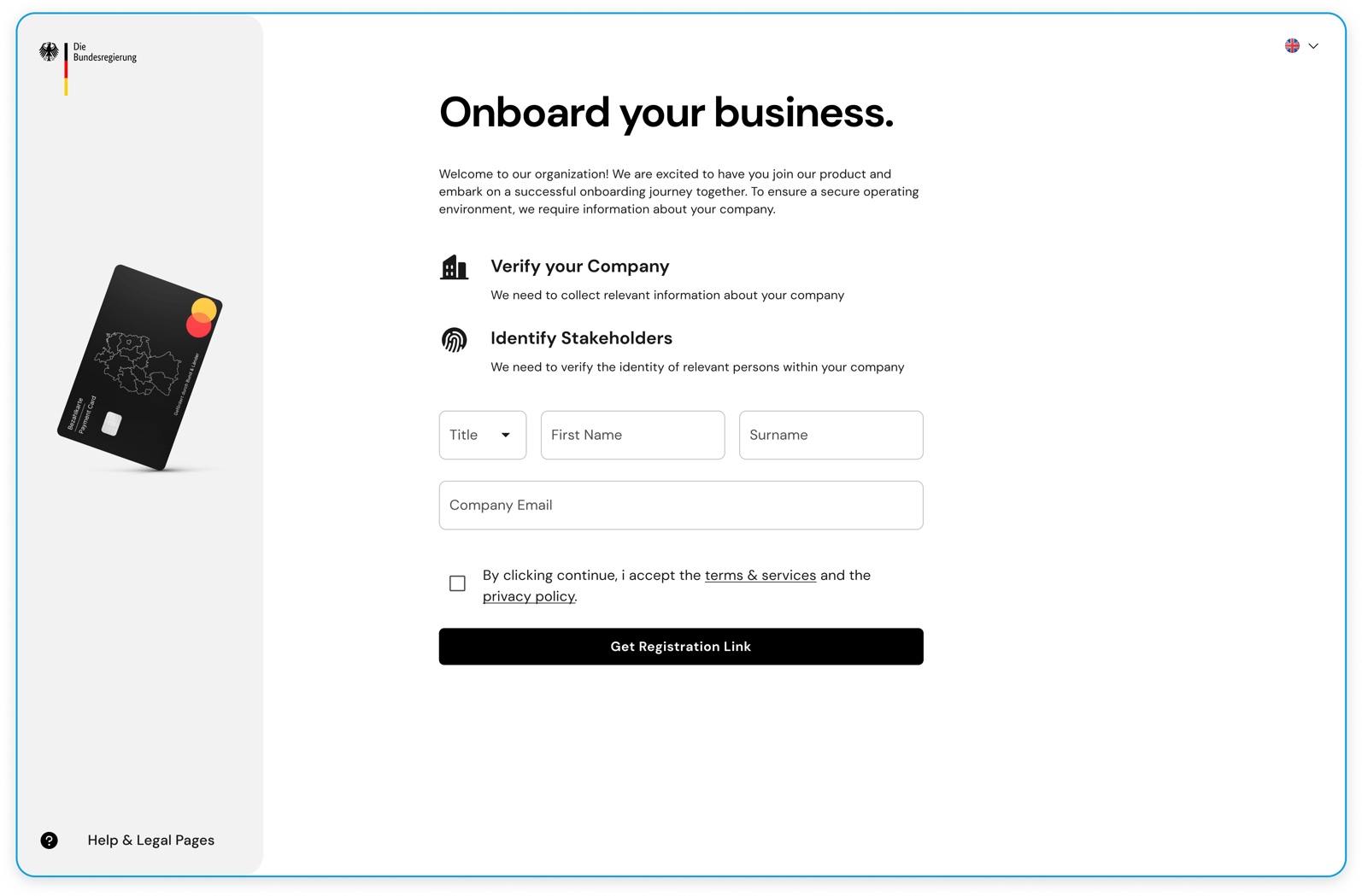

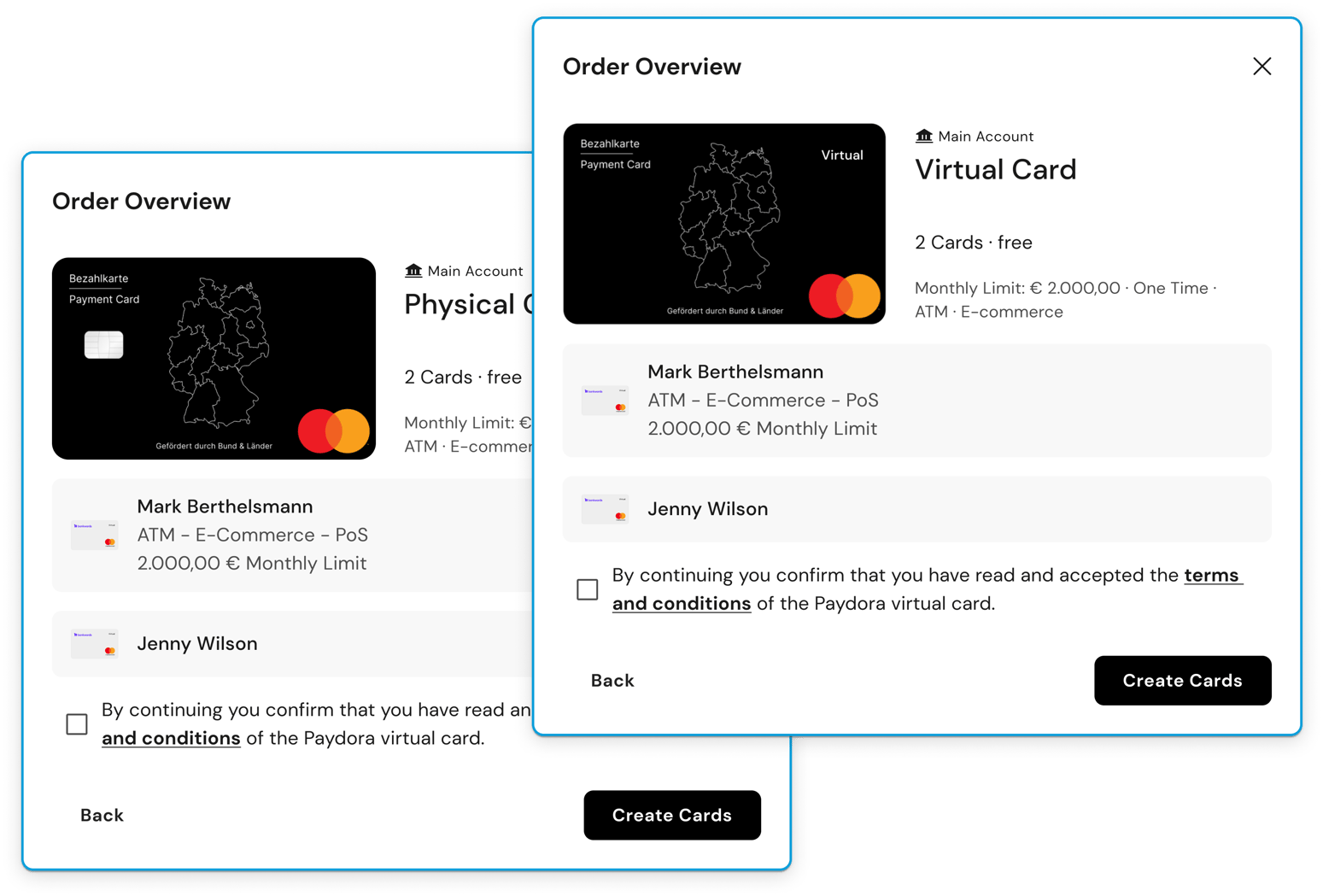

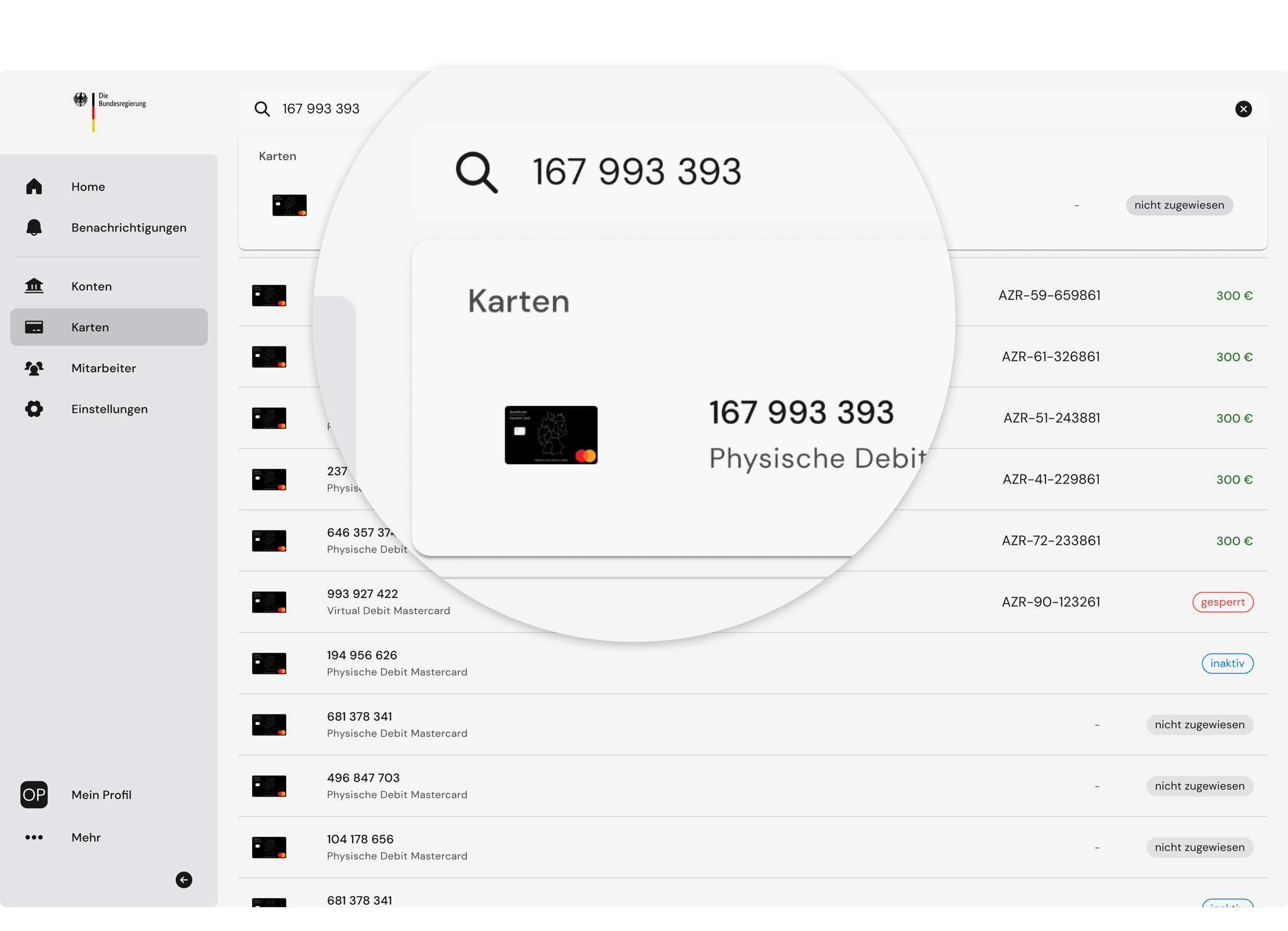

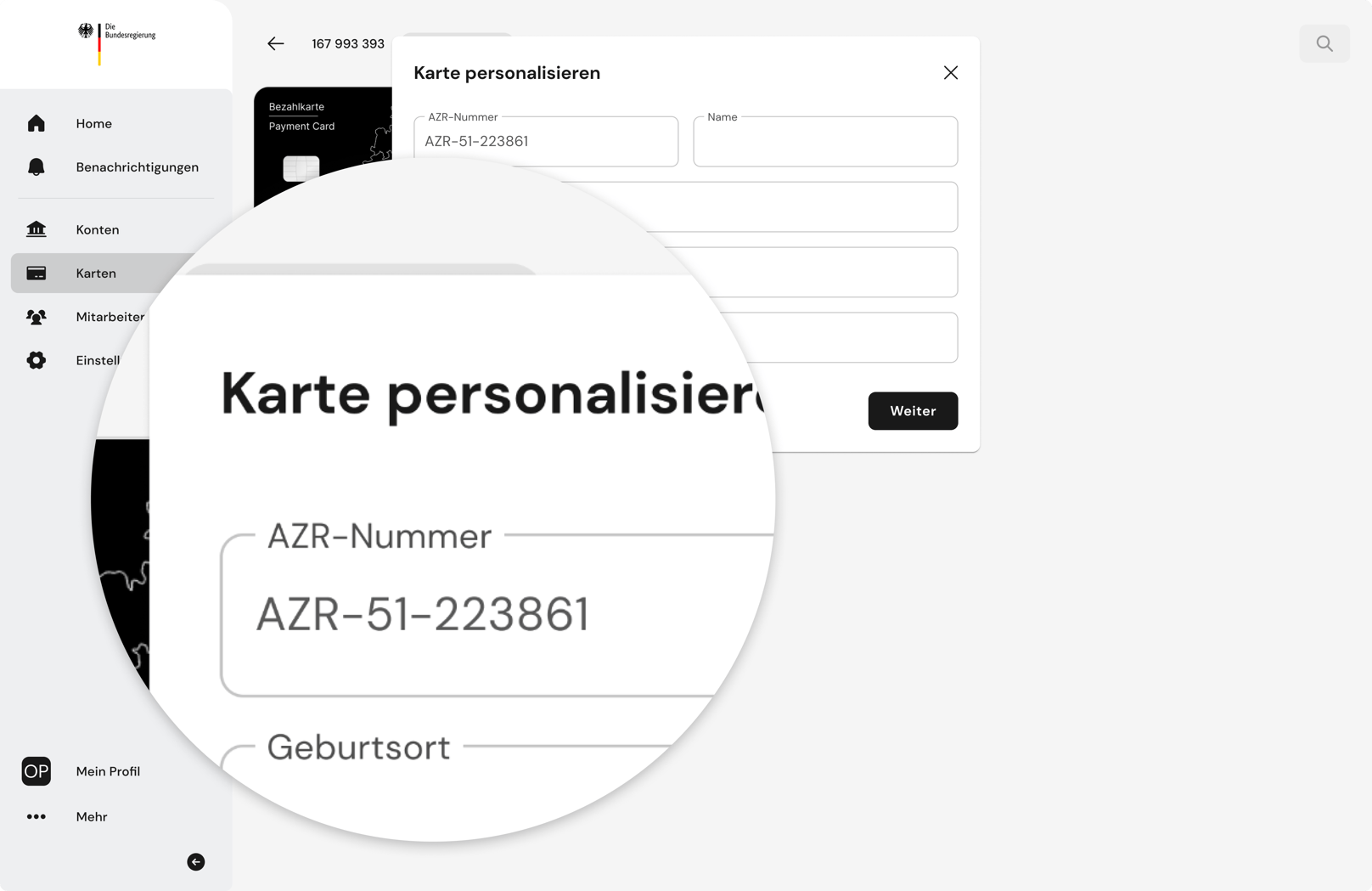

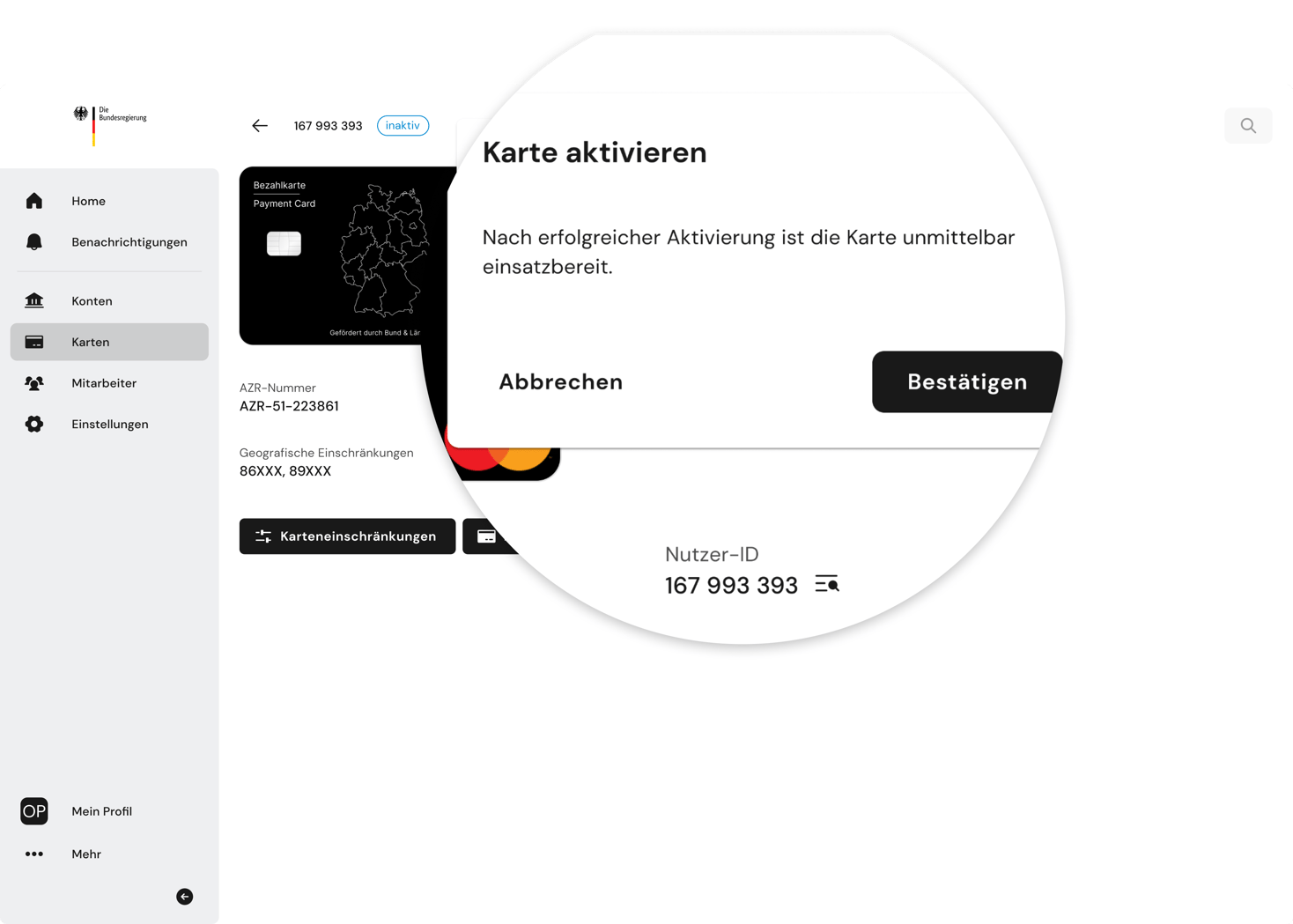

✔️ Effiziente Kartenausgabe zum sofortigen Einsatz mit höchsten Compliance-Ansprüchen – Personalisierung/Verknüpfung der AZR. Nr. mit bevorrateten Karten vor Ort (Karten sind vor Aktivierung wertlos und können risikolos verwahrt werden)

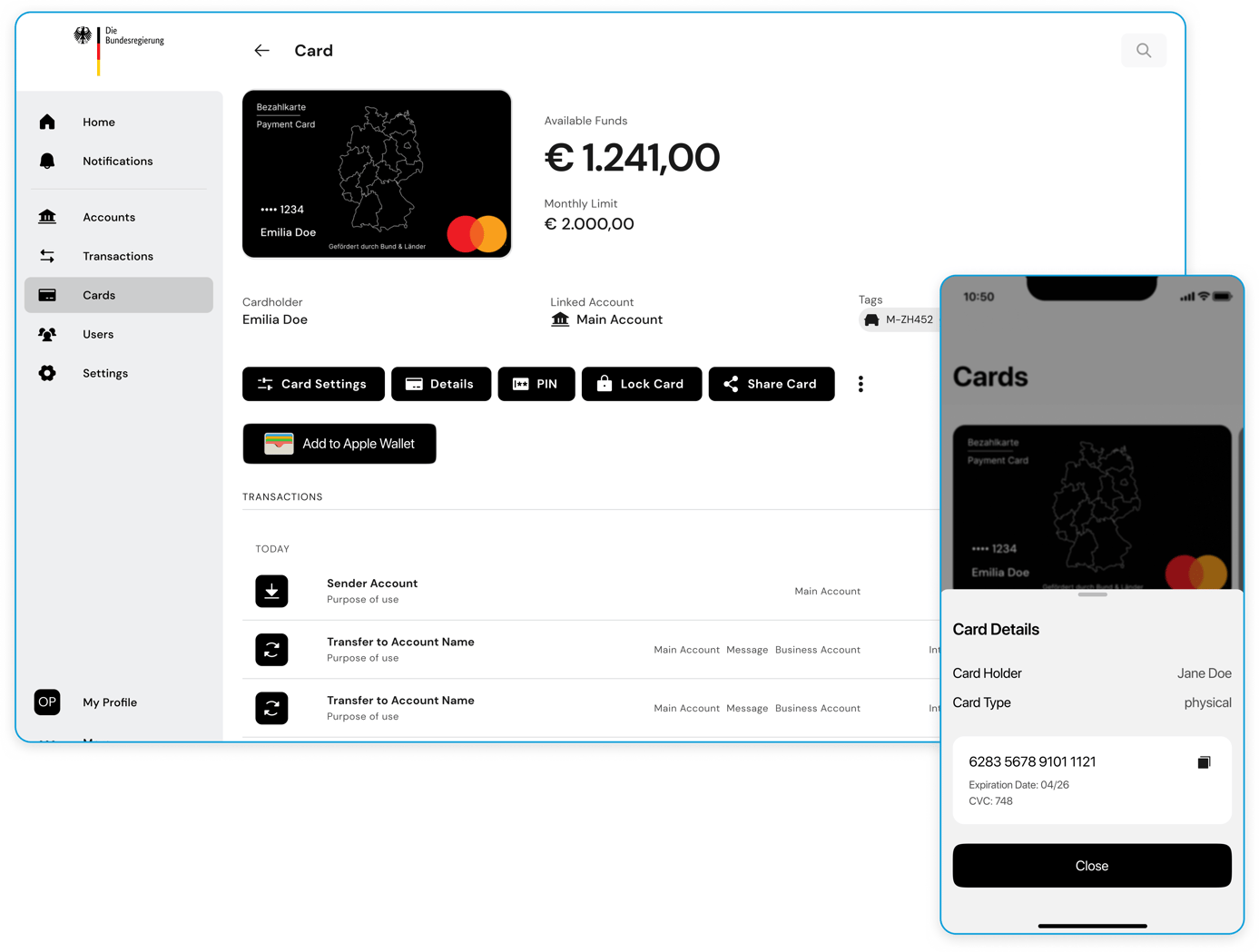

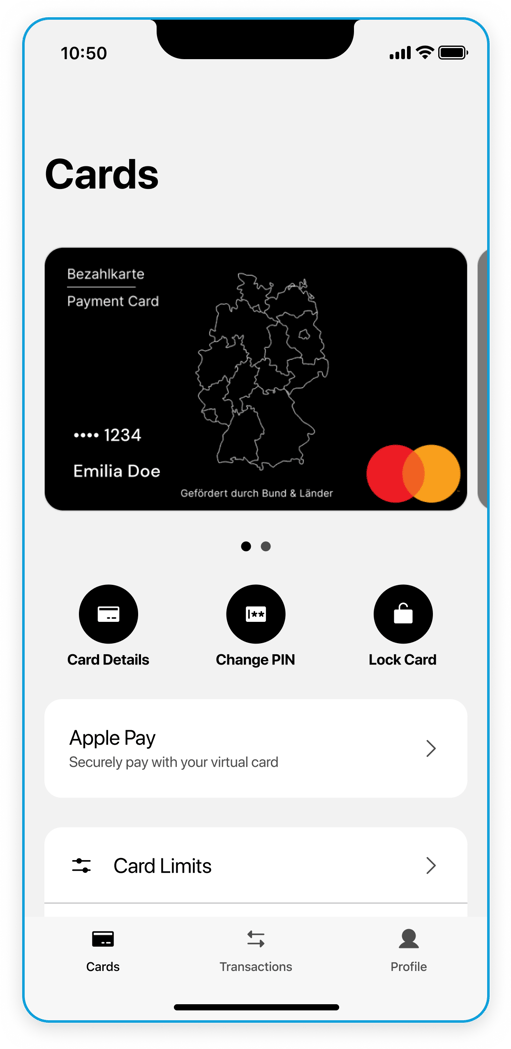

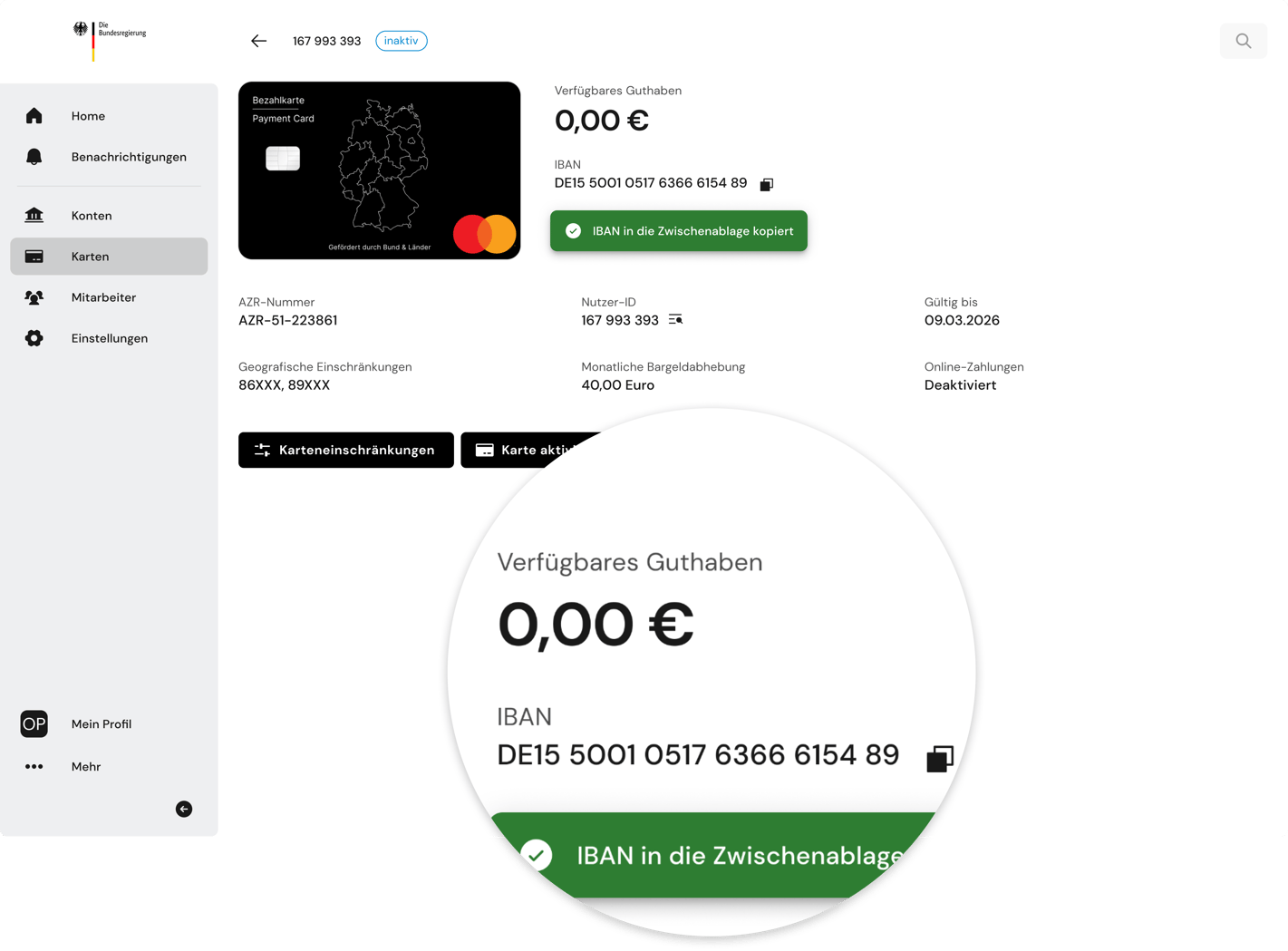

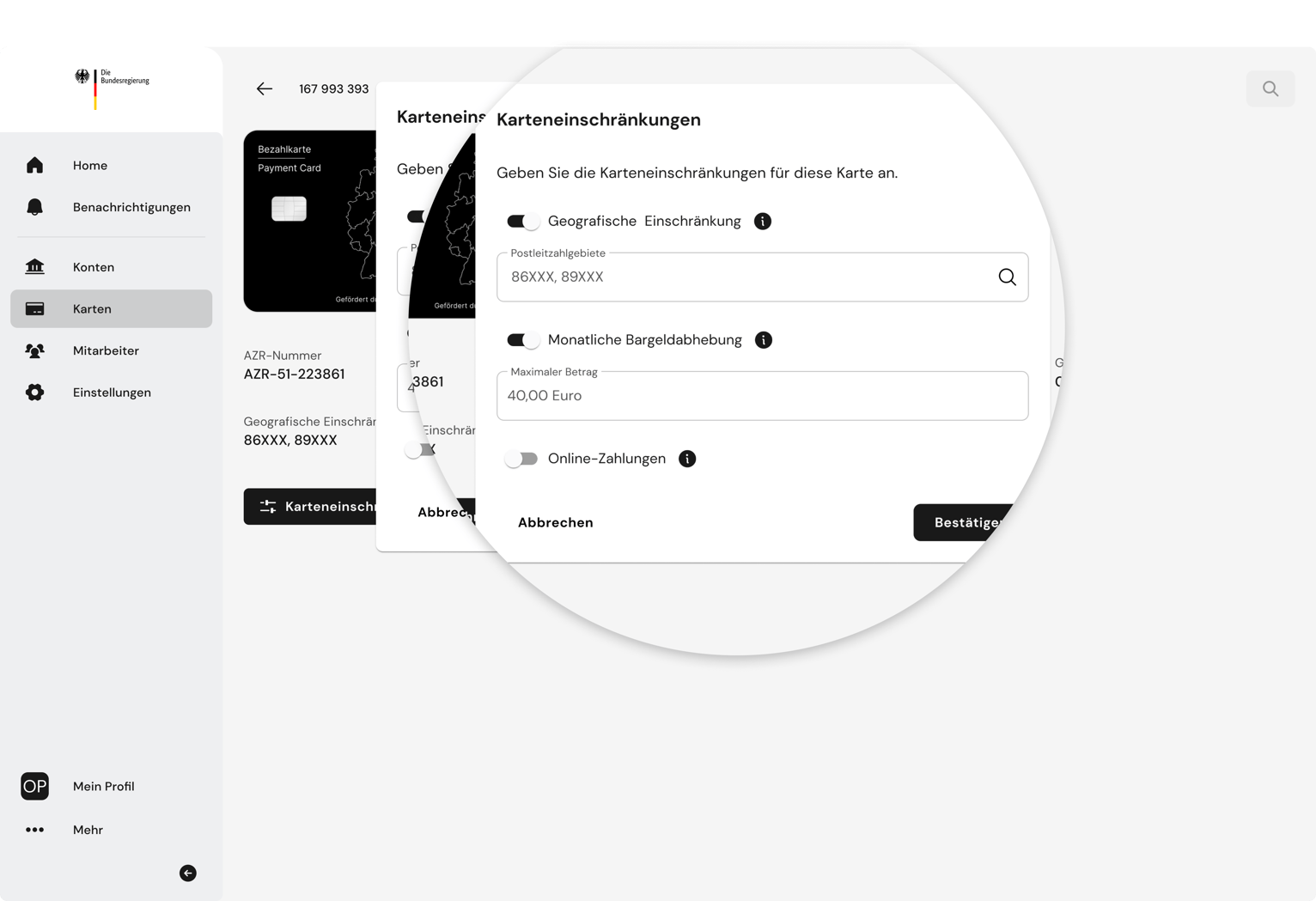

✔️ Granulare Limitierung (Händler, Region/PLZ, Bargeld, etc.) – individuelle Einstellungen jederzeit durch die Leistungsbehörde möglich und anpassbar

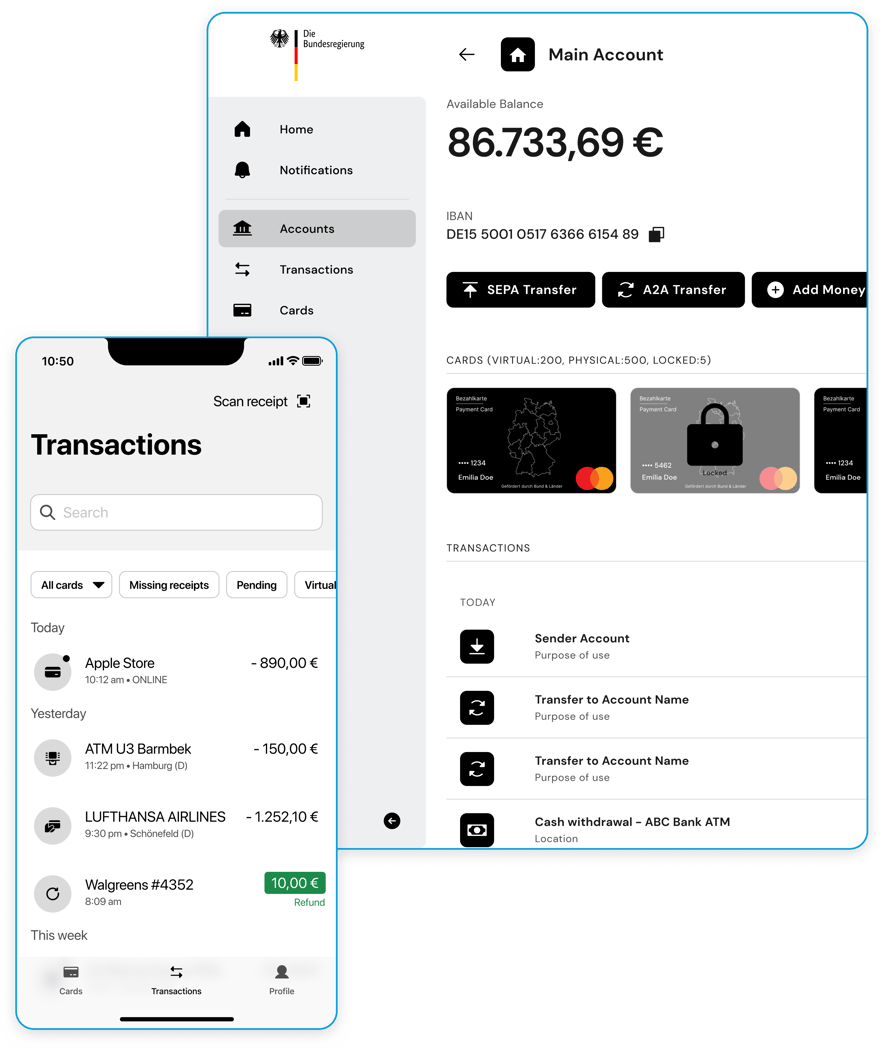

✔️ Steuerung von (limitierter) Bargeldausgabe an Geldautomaten & POS ersetzt den Bargeldprozess komplett; ergänzend kann Bargeld auch bei vielen großen Einzelhandelsketten bezogen werden

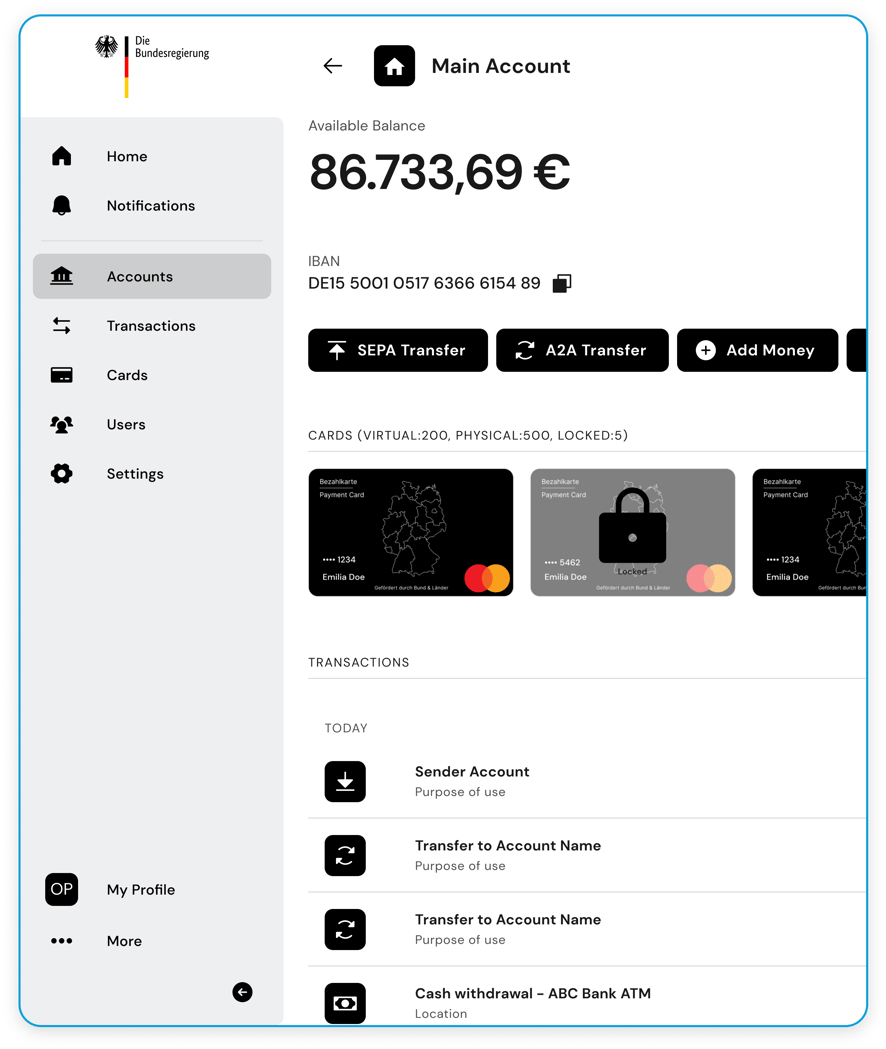

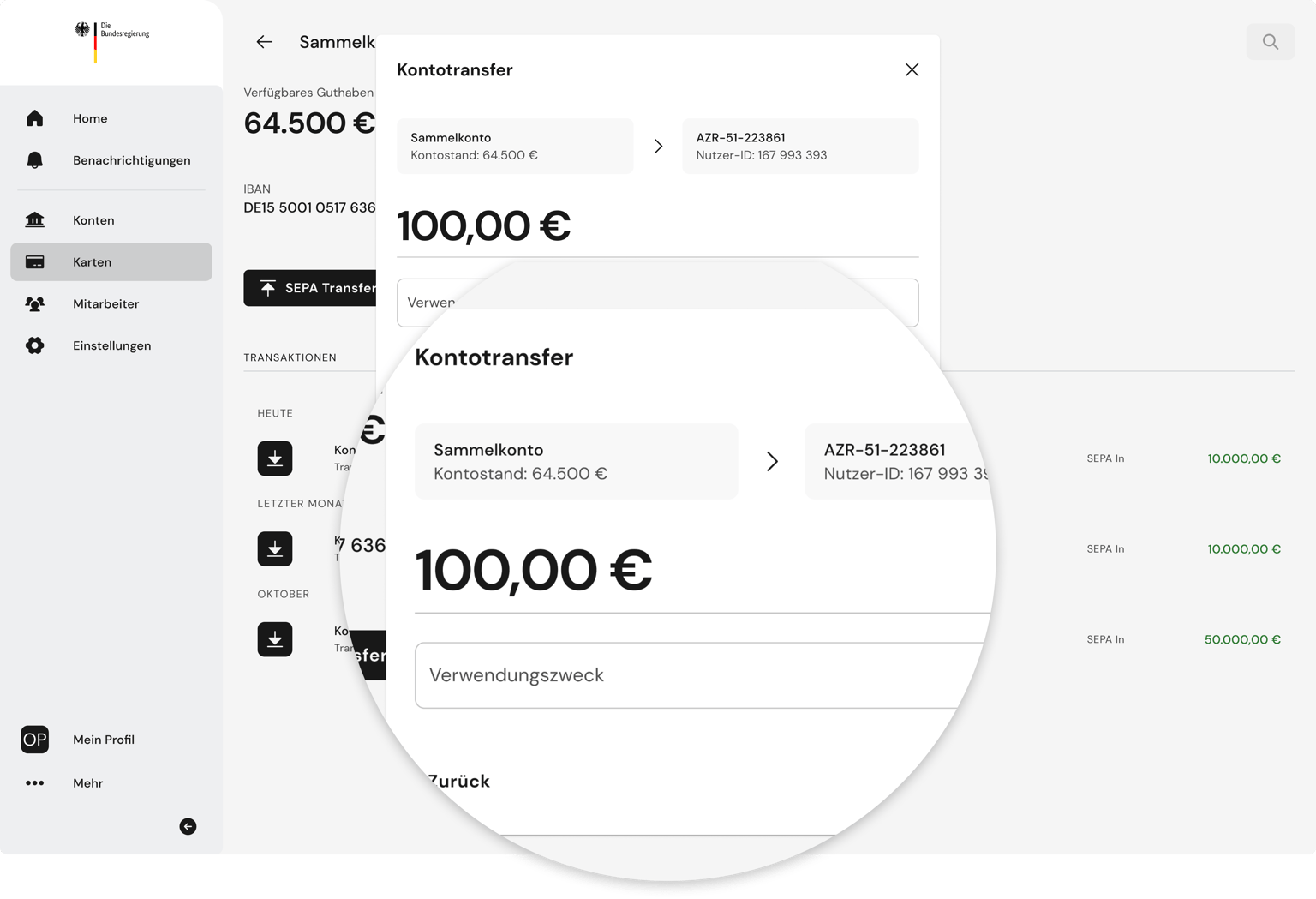

✔️ Verwaltungsoberfläche – wiederholte/einfache & sofortige Mittelbereitstellung im anwenderfreundlichen Prozess inkl. Rechte-/Rollenkonzept

✔️ Hybrider Aufladeprozess – Initiale Aufladung zur sofortigen Kartennutzung via Direkttransfer von einem Sammelkonto oder SEPA-Instant, ergänzt um regelmäßige Aufladung via SEPA-Überweisung direkt aus den Fachverfahren durch Adressierung der Karten via hinterlegter IBAN

✔️ Keine Barrieren (Mobiltelefon/App) für die Nutzung & Verwaltung der Karte, intuitives WWW Frontend

✔️ Lastfähige IT Infrastruktur – industrielle Skalierbarkeit und maximale Zuverlässigkeit

✔️ Mandantenfähigkeit “Tenant-Architektur” – Föderale Vorgaben einfach anpassbar

✔️ Optionale Anbindung an die bestehenden Fachverfahren möglich via bestehender API (z.B. OK.Sozius, PROSOZ, LÄMMkom LISSA, Care4 etc.)

✔️ Umfassende Erfahrung im hochskalierten Endkundengeschäft – exzellente 24/7 Service Prozesse in allen relevanten Sprachen via Telefon und Chat

✔️ Schnell verfügbare Lösung und kurze Projektlaufzeit – risikolose Pilotierung jederzeit möglich

✔️ Regionale Wertschöpfung – Gesamter Leistungsprozess aus einer Hand weitgehend in Deutschland

.png?width=180&height=31&name=App%20OV_Logo_Black@2x(1).png)